Everything about Paypal Business Loan

Wiki Article

Paypal Business Loan for Beginners

Table of ContentsThe Basic Principles Of Paypal Business Loan Paypal Business Loan - An OverviewPaypal Business Loan Can Be Fun For Everyone10 Simple Techniques For Paypal Business Loan

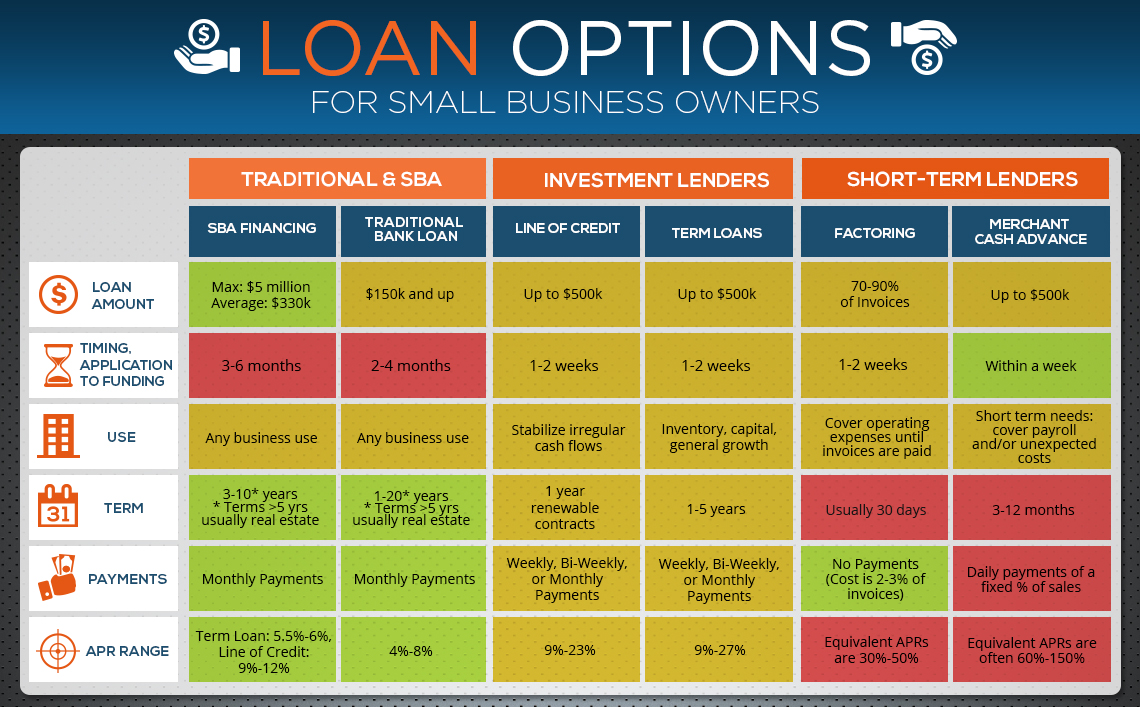

The SBA functions as the guarantor between the borrower and also the lender (PayPal Business Loan). In return, lending institutions present their conditions, interest price caps and also various other requirements which require approval from the SBA.The SBA supplies different strategies as well as you can pick any type of strategy which might fit your company requirementfor instance, getting inventory, paying financial debts or home mortgages, expanding your company, or perhaps for acquiring actual estate.SBA lendings do call for a thorough application procedure, a personal credit scores check, and also security requirements, so they aren't right for everyone. When you listen to the word "financing," a term car loan from a major bank is most likely among the initial points that comes to mind. A term loan is defined as a lump sum, paid to a debtor with an agreement to repay it over a set amount of time, with passion - PayPal Business Loan.

All you need to do is to stay within that credit line. Use your credit history properly and also make prompt month-to-month settlements, and also you can make use of the credit rating amount as numerous times as you like while developing a positive debt history for your service. Entrepreneur who do not have collateral or a strong enough credit rating to acquire term finances can rely upon business bank card for fast financing.

Debt spiral threat: It is easy for balances and also passion to accumulate if you are not able to make your regular monthly settlements promptly. If you miss out on one repayment, the unsettled balance surrender to the following payment period, and also you will be billed rate of interest on the brand-new amount, meaning your following settlement will be higher.

4 Easy Facts About Paypal Business Loan Described

This can swiftly develop an ever-increasing hole of financial debt and it's extremely hard to climb up out without a huge infusion of money. Credit line: All service bank card feature limits, and staying within your limit can often confirm to be a problem. You could get around this by utilizing several cards, or you may be able to negotiate higher limitations gradually.Unfortunately, when it concerns bank card, you're at the mercy of the credit report provider. Can't use it for all sorts of repayments: Local business proprietors that require quick moneying to make payroll or pay rental fee generally can't make use of charge card to make these specific kinds of settlements. Based on your personal credit scores: Also most company bank card are still linked to the find more information business proprietor's individual debt.

One advantage of a Seller Cash Loan is that it is relatively easy to obtain. Another advantage is that entrepreneur can receive the cash within a couple of days. It is not suitable for businesses which have useful content few credit card deals, since they won't have adequate transaction quantity to get approved.: In billing factoring, the lender purchases unpaid billings from you and also gives you many of the billing quantity upfront.

Billing factoring allows you to get the cash that you need for your organization without waiting for your clients to pay. You have to additionally have solid credit scores background and also a track document of consistently-paying customers.

The Ultimate Guide To Paypal Business Loan

Let's take a complete appearance at exactly how Fundbox operates in order to understand why it can be a good alternative for your service loan. Below are some points to understand about Fundbox: Choice within hours: You can register online in seconds and also obtain a credit report decision in hours. As soon as you determine to register, all you need to do is connect your accountancy software or organization financial institution account with Fundbox.

If you pay early, then the later fees can obtain removed. As a small service proprietor, you understand that there are a great deal of financing alternatives out there. We wish this overview helps you start to pick which option makes one of the most sense for you. Consider the complying with information concerning your service prior to making your next step: Personal credit rating: Have a look at your individual credit report.

Unknown Facts About Paypal Business Loan

If your credit report rating is ordinary or reduced, then you will most likely have to pay higher rates of interest or you may be declined entirely. Service debt: Ensure that your company has a excellent credit rating rating, as the loan providers will certainly take your company credit score into consideration prior to approving it for a loan.Organization income: The borrowing choices will vary depending on the means your business produces earnings. It utilized to be that a significant financial institution was one of your only alternatives for getting accessibility to a company line of credit scores, yet not anymore - PayPal Business Loan.

Report this wiki page